The first major law passed by President Donald Trump, "The Tax Cuts & Jobs Act of 2017", was signed into law December 22nd 2017. It was the most significant tax cut since the 1986 Tax Reform Act.

Tax Reform

The new law provided lower taxes for most Americans accumulating wealth. Below are the new tax brackets:

| Tax Rate | Single | Married Filing Joint | Married Filing Separately |

| 10% | $0 to $9,700 | $0 to $19,400 | $0 to $9,700 |

| 12% | $9,701 to $39,475 | $19,401 to $78,950 | $9,701 to $39,475 |

| 22% | $39,476 to $84,200 | $78,951 to $168,400 | $39,476 to $84,200 |

| 24% | $84,201 to $160,725 | $168,401 to $321,450 | $84,201 to $160,725 |

| 32% | $160,726 to $204,100 | $321,451 to $408,200 | $160,726 to $204,100 |

| 35% | $204,101 to $510,300 | $408,201 to $612,350 | $204,101 to $306,750 |

| 37% | $510,301 or more | $612,351 or more | $306,751 or more |

How Tax Brackets Work

Being “in” a tax bracket doesn’t mean you pay that federal income tax rate on everything you make. The progressive tax system means that people with higher taxable incomes are subject to higher federal income tax rates, and people with lower taxable incomes are subject to lower federal income tax rates.

The government decides how much tax you owe by dividing your taxable income into chunks — also known as tax brackets — and each chunk gets taxed at the corresponding tax rate. The beauty of this is that no matter which bracket you’re in, you won’t pay that tax rate on your entire income.

Let's Look at an Example:

Most people over-estimate their effective tax rate, as they are more focused on the 'highest' marginal tax rate. Below is an example of a married couple filing jointly with a taxable income of $200,000:

- 10% $0 to $19,400 $ 1,940 plus

- 12% $19,401 to $78,950 $ 7,146 plus

- 22% $78,951 to $168,400 $19,697 plus

- 24% $168,401 to $321,450 $ 7,584

Total: $36,349

In the example above, the total tax due on $200,000 is $36,349. Although the highest marginal tax rate is 24%, the effective rate is only 18.2%.

Historical Perspective

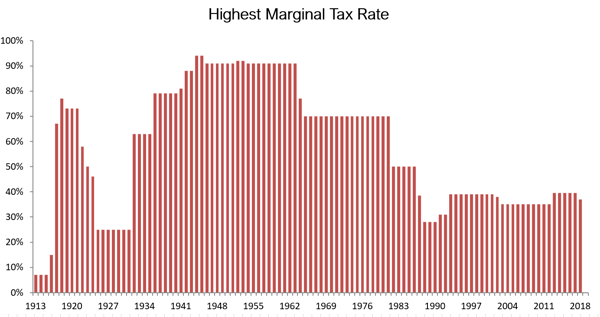

No one feels that today's tax rates are too low. In fact, the consensus is that we all pay too much in taxes. However, when you look at it from a historically, our tax rates today are quite low.

In the past, we have experienced much higher marginal tax rates, and as result, effective tax rates were higher as well.

Impact of Tax Rates on Financial Planning

When putting together a financial plan, you must consider both current and future tax rates. With the US National debt over $23 trillion (see UsDebtClock.org), and budget deficit over $1 trillion, it is hard to image tax rates going down in the future. If tax rates go up in the future, it will make sense to consider how Cash Value Life Insurance can mitigate the impact of future tax rates (see our blog Selling IUL).

Advisors Resource Company has the experience and expertise to help you with the use of life insurance an any financial plan. Our Leverage Life Process will give you the tools and confidence to bring these solutions to your clients.

Tags:

marginal tax rateDecember 13, 2019