Essentially, a wealth transfer plan is the process of positioning assets, that you wish to pass on to your children and grandchildren, so they may be transferred in an efficient manner to the next generation. An effective wealth transfer plan will allow you to transfer wealth to your family in a financially sound and tax-advantaged manner.

Individual Retirement Accounts (IRAs)

Individual Retirement Accounts (IRAs) have for years been the most popular retirement savings alternative for people who want good returns and tax savings for their retirement.

An important feature of an IRA is that it allows you to take an income-tax deduction on the money you contribute to the plan and compound yearly earnings free of current tax. This tool is attractive to those who wish to accumulate money for purposes such as supplemental retirement income; as long as it is understood that when money is withdrawn from the plan taxes must be paid on the money that is withdrawn. Traditionally, if the individual still has funds left in their IRA after his or her death, those assets will be transferred to a specified beneficiary.

Most other individually owned assets receive a step-up in cost basis upon the death of the owner, eliminating all capital gains on those assets up to that point in time; But not IRAs. The beneficiary of your IRA will pay ordinary income tax on any distributions at his or her rate. Consequently, all of the money in the plan, including all of the deposits and all of the gain, is subject to income tax when received by the beneficiary.

Life Insurance .png?width=300&name=Copy%20of%20Copy%20of%20Untitled%20(4).png)

Some may say the solution to avoiding this tax issue would be to convert your traditional IRA into a Roth IRA. Roth IRAs have the potential to grow tax-free, which may help you save more over time. Plus, withdrawals aren't mandatory during the lifetime of the original owner, and Roth IRA assets may pass to your family tax-free. The downside is you may need to pay the tax at the time of conversion.

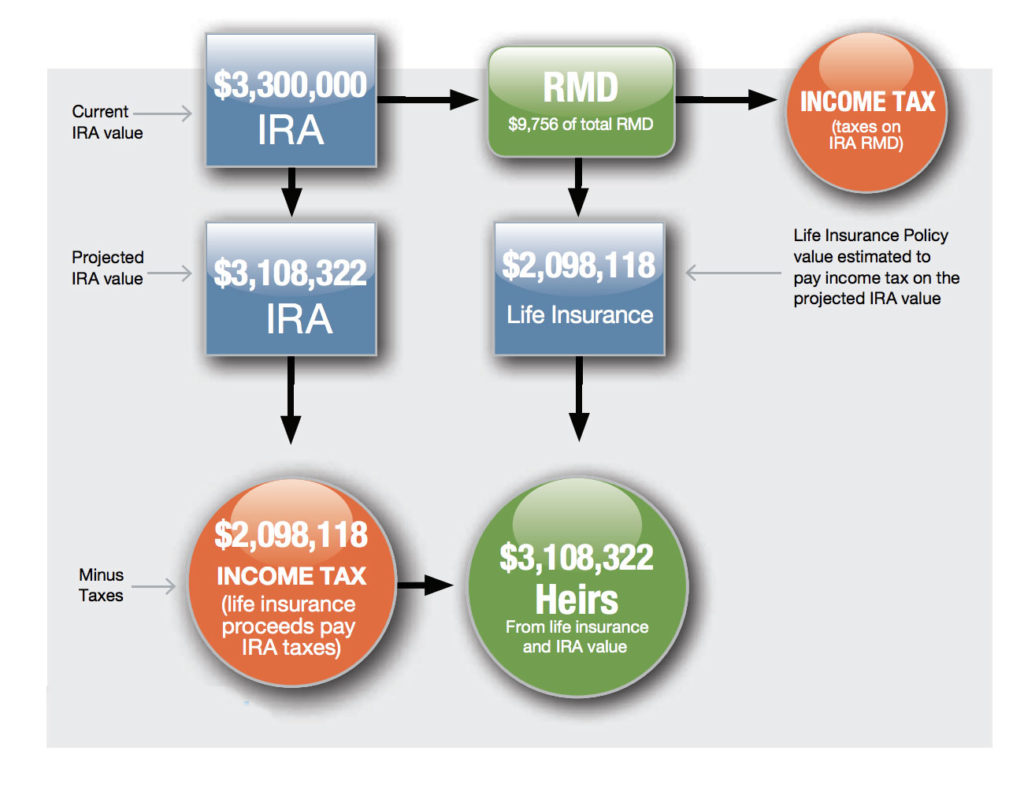

However, a better solution would be to use life insurance to pay the equivalent Roth IRA conversion taxes after your death. Rather than converting to a Roth IRA and paying the taxes lump-sum now, a more affordable strategy could be to purchase, with installment payments, a permanent life insurance policy with a death benefit equal to what the IRA taxes are likely to be, allowing you to pay the taxes after your death.

Related Post: How Does Indexed Universal Life Insurance Work?

Life insurance offers three valuable benefits not found in an IRA:

- Tax-deferred earnings that build cash value faster.

- Tax-free access to the cash value via loans that do not have to be repaid.

- Tax-free death benefits.

How it works:

Assumptions: IRA balance $3,300,000 IRA annual return 6% Income tax rate 35% Estate tax rate 50% Projected value based on life expectancy.

Results: Naming the beneficiary of both the IRA and the insurance policy allows you to use the death benefit proceeds from the insurance policy to cover the cost of taxes on the inherited IRA. Life insurance death benefits passed to a beneficiary are income tax-free.

Summary

Only the premiums that are not used towards life insurance coverage are used to build tax-deferred cash value. In comparison, all money put into an IRA will grow tax-deferred. And since permanent life insurance is used for a death benefit, as well as a cash accumulation tool, the owner’s age and overall health can have a huge impact on premium costs, which would ultimately hurt the accumulation. However, the added death benefit of life insurance pays tax-free dollars to the designated beneficiaries should the owner die prematurely.

Although life insurance can generate a considerable amount of cash value, this product must be properly funded by the owner in order for it to perform as intended. Allowing the policy to lapse can actually leave the policyholder with a large tax bill, so the owner should be advised that this is a long-term planning strategy with potentially significant penalties if the policy is surrendered or lapses.

Ultimately, a person who wants to invest in either of these products should consider all their options and seek the advice of an independent financial or insurance professional to decide which method is right for their personal situation.

1 May be subject to limitations; consult with your personal tax professional

*Neither Advisor’s Resource Company nor its agents give legal or tax advice. Please consult your tax advisor or attorney about your specific situation.

“In this world nothing can be said to be certain, except death and taxes.”

- Benjamin Franklin

November 15, 2017