A section 162 executive bonus plan is a way for business owners or companies to provide additional supplemental benefits to key-employees or executives of their choice in a manner that is simple in design and easy to implement. As the name suggests, a section 162 executive bonus plan is specifically designed to attract, reward, and retain executives and high-level employees.

Indexed Universal Life (IUL) Insurance can serve as a powerful tool and key-component for this type of strategy. A section 162 executive bonus plan utilizing life insurance has several advantages including:

- A section 162 executive bonus plan is simple to implement and easy to administer.

- The business can selectively choose the key-employee(s) they wish to reward.

- The bonus payments may be considered a fully deductible expense to the company.

- The key-employee is able to name the beneficiary of the entire death benefit of the life insurance policy.

- In many cases, unless there is a “restricted or controlled executive bonus”, the key executive will have immediate access to policy cash value and may access that cash value without income tax through policy loans and withdrawals.

- A Section 162 Executive Bonus Plans are not subject to “qualified plan limits”.

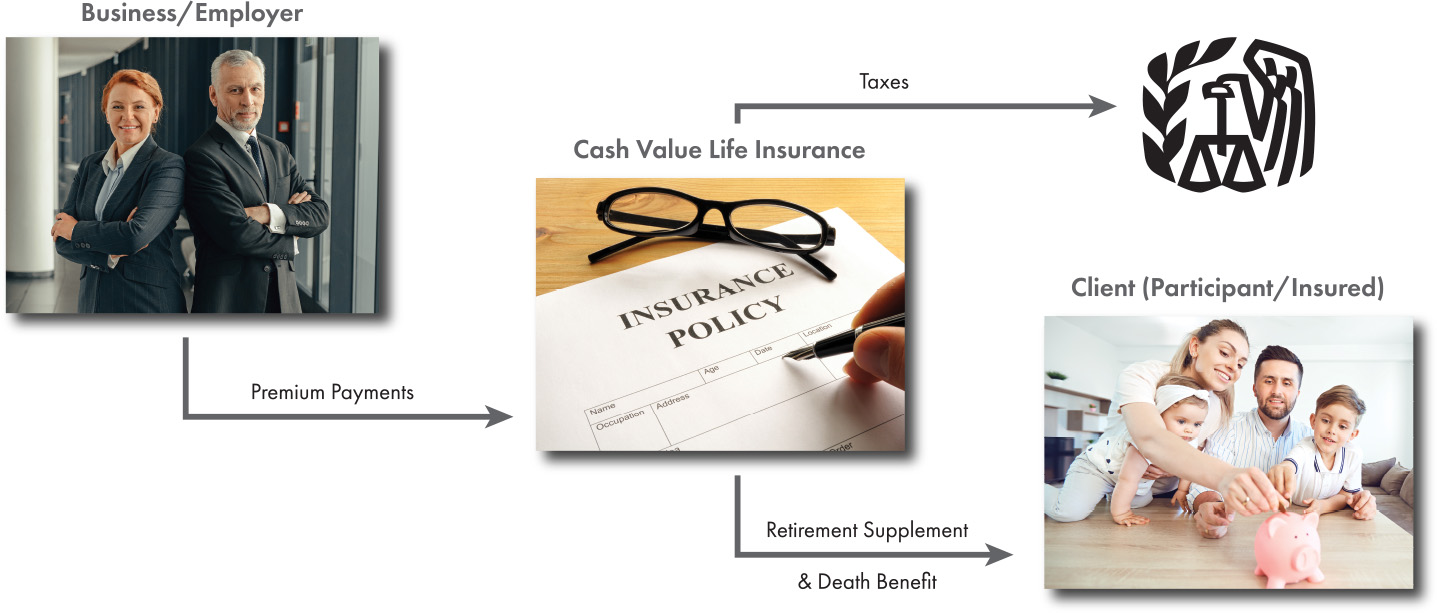

How it Works:

- The participant establishes a life insurance policy on his or her own life. They are the owner and the select whoever they’d like as the beneficiary. The policy is funded from the business and the premiums are considered income to the participant. Depending on the tax status of the business, this could be considered income from the business or possibly a section 162 bonus. Consult with your tax profession to determine the most optimal way.

- In the second policy year after the initial premium is paid, the owner/participant takes a loan from the policy to pay for the income tax on the premium contribution from the business. This is done so that we can leverage the taxes that the participant would have otherwise paid out of pocket. This provides a small amount of leverage in the policy and improves the growth potential.

- The premium payments and loans can continue for as long as the participant and the business would like. Should the business not be around any longer, the participant is free to make his or her own contributions.

- The client may take tax-free income from the policy’s cash value OR retain the death benefit for estate planning purposes. Alternatively, they could do some combination of both.

How to Get Started:

At Advisor’s Resource Company we are experts in the life insurance industry, specializing in developing advanced life insurance strategies for business owners and high-net-worth individuals.

Tags:

November 28, 2022